Table of Contents

- Planning for Personal Tax Laws Changing in 2026 | Mercer Advisors

- Will Tax Rates Sunset In 2026? How to Plan Ahead - YouTube

- Tax Rates Sunset in 2026 and Why That Matters - Barber Financial Group

- Plan now? The estate planning 2026 question mark | MassMutual

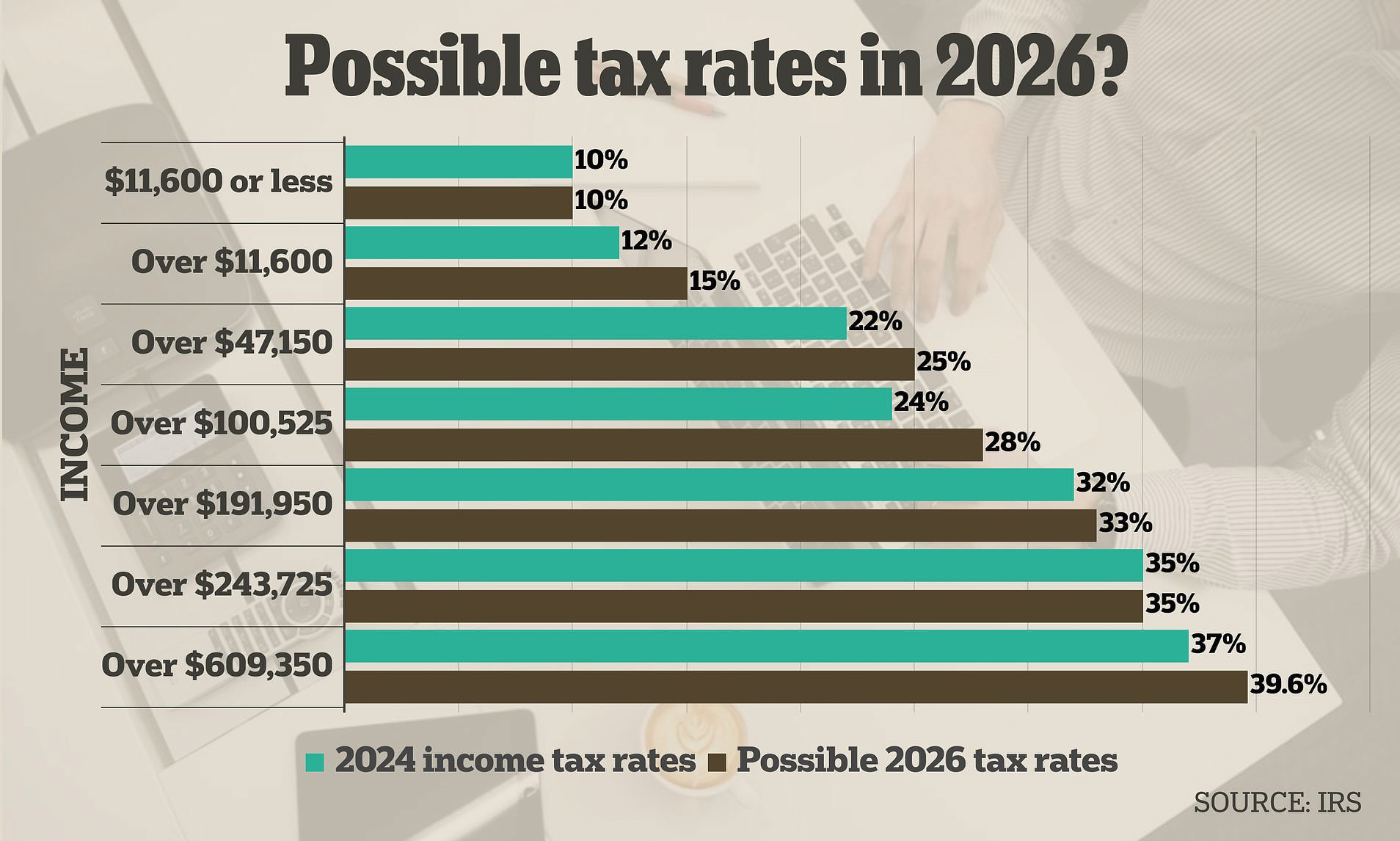

- The reason why you may have to pay MORE tax in 2026

- Tax Plan 2026 World - James P. Walker

- T22-0091 - Share of Federal Taxes - All Tax Units, By Expanded Cash ...

- 2025 Tax Brackets Married Filing Single - Charlotte H. Bishop

- Planning for Personal Tax Laws Changing in 2026 | Mercer Advisors

- 2026 Income Tax Increase - YouTube

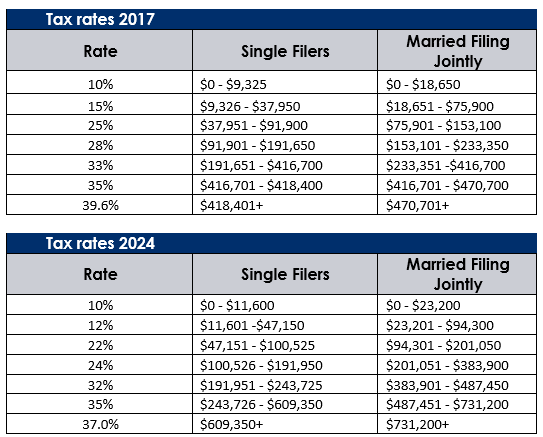

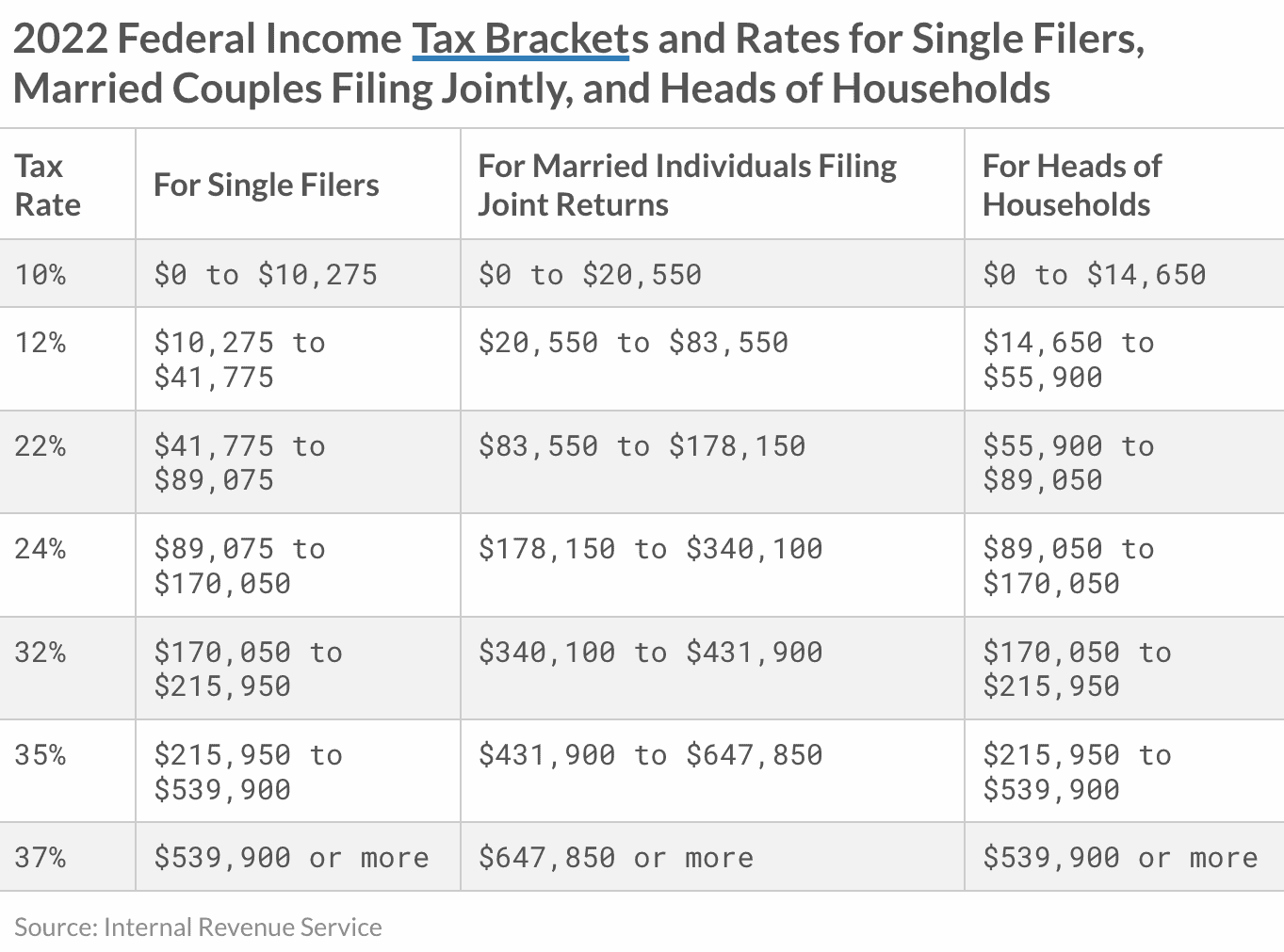

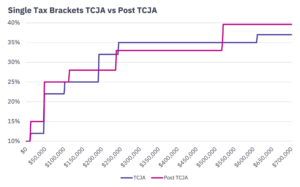

Tax Brackets and Rates for 2025

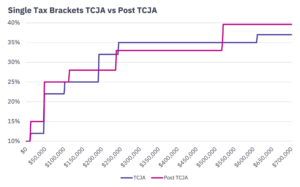

Tax Brackets and Rates for 2026

Tax Brackets and Rates for 2027

The tax brackets and rates for 2027 are expected to be: 10%: $0 to $11,400 (single) or $0 to $22,800 (joint) 12%: $11,401 to $45,700 (single) or $22,801 to $91,400 (joint) 22%: $45,701 to $97,200 (single) or $91,401 to $194,400 (joint) 24%: $97,201 to $184,900 (single) or $194,401 to $369,400 (joint) 32%: $184,901 to $235,700 (single) or $369,401 to $471,400 (joint) 35%: $235,701 to $589,300 (single) or $471,401 to $711,400 (joint) 37%: $589,301 or more (single) or $711,401 or more (joint)